Your Business Advanced Tax Consultant

Nowadays, accounting is not just an way in compliance and saving on paying tax! Accountants are increasingly playing more of a partner role with business owners ranther than just a service provider that you see for a certain time.

Drop us a message

Our Services

Finance

Proudly provided by our partner

advantage finance group

Home Loan / Investment Loan /SMSF Loans

Construction Loan

Car Loan & Car Buying Services

More

Tax Returns

INDIVIDUAL TAX TERTURNS

COMPANY TAX RETURNS

FAMILY TRUST TAX RETURNS

PARTNETSHIP TAX RETURNS

Know More

Book Keeping

Book Keeping Services

XERO

MYOB

QuickBOOK

More

Tax Returns

INDIVIDUAL TAX TERTURNS

COMPANY TAX RETURNS

FAMILY TRUST TAX RETURNS

PARTNETSHIP TAX RETURNS

Know More

Finance

Proudly provided by our partner

advantage finance group

Home Loan / Investment Loan /SMSF Loans

Construction Loan

Car Loan & Car Buying Services

More

BAS/IAS

BAS LODGEMENT

IAS LODGEMENT

Know More

We Know Our Finance work?

Home / Investment Loan

Personal Loan

Construction Loan

Business Loan

Car Loan

SMSF Loan

Do I need to register for GST?

If the business has a GST turnover (gross income minus GST) of $75,000 or more, your business must register for GST. However, under some specific circumstances, your business to register for GST is necessary. If you are not sure, you can talk with our expert any time.

What is individual tax deduction?

When completing your personal tax return, you’re entitled to claim deductions for some expenses, such as all work-related expenses, interest and dividend deductions, gifts or donations and other deductions etc. Please be aware that to well keep expenses related records (receipts/log) are important as the ATO would ask to substantiate the claims.

Keys Things to Know

You will only be required to lodge a BAS when you have registered for the Goods and Services Tax (GST).

If the business has a GST of $75,000 or more, your business must register for GST. However, Under some specific circumstances, your business to register for GST is necessary.

If you are not sure, You can talk with our expert any time.

Contact us

Blacktown Office

Suite 2/ 5 Patrick Street, Blacktown NSW 2148

Ph (02) 9622 2526

Fax (02) 9622 9590

Trading Hours

Monday 9am-5pm

Tuesday 9am–5pm

Wednesday 9am-5pm

Thursday 9am–7pm

Friday 9am–5pm

Saturday 9am-4pm

Sunday 10am-4pm

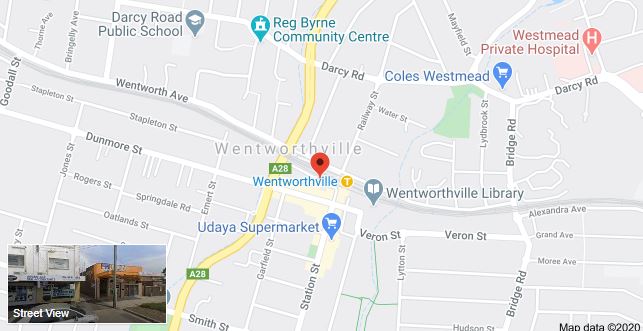

Wentworthville Office

14 The Kingsway, Wensworthville, NSW, 2148

Ph (02) 9631 3354

Fax (02) 9896 4756

Trading Hours

Monday 9am-5pm

Tuesday 9am–5pm

Wednesday 9am-5pm

Thursday 9am–7pm

Friday 9am–7pm

Saturday 9am-4pm

Sunday- Close

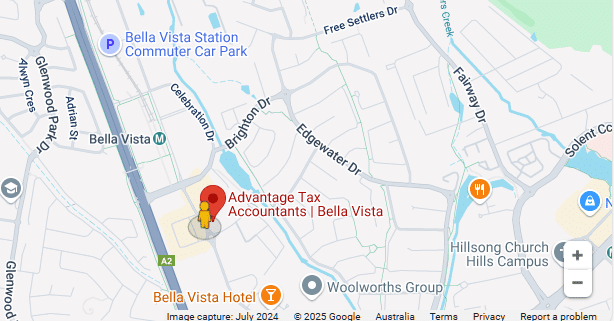

Bella Vista Office

1.15/29 - 31 Lexington Dr, Bella Vista NSW 2153

Ph (02) 8850 3704

Fax (02) 8850 3704

Trading Hours

Tuesday 9am - 5pm

Wednesday 9am - 5pm

(Other days: Phone appointment ONLY)

** Please contact our office for more details

Saturday 9am-4pm

Sunday - 10am-4pm